Listen to this Blog:

Cell therapy is a large and growing market, with industry analysts estimating a global market size of $22B in 2022 and a CAGR of 14.15% by 2030 (Grandview Research). 1 There are ~15 FDA-approved cell therapies (BioInformant), 2 and more than 1000 active or recruiting US clinical trials posted since 2017 that are evaluating cell therapy treatment modalities (celltrials.org 3 with input from clinicaltrials.gov). Furthermore, we saw 17 corporate M&A deals in cell therapy world-wide, totaling ~$5B in 2022 alone, with a median deal size of ~$340M (PitchBook). Headline deals included Sartorius‘ acquisition of Albumedix for ~$502M, 4 the $2.6B reverse merger by ProKidney, 5 and the sale of CDMO BioCentriq to GC for $73M. 6

With scientific advancements, cell therapy has affirmed for the markets an unprecedented shot at saving and improving lives in high unmet need therapeutic areas. It is no wonder we have seen the emergence of 77 new companies in this vertical over the past two years (PitchBook). However, though the numbers suggest an ease to market entry, starting a biotech company from the ground up could still be quite a bumpy ride.

Startup and Never Look Down

There are many considerations a cell therapy startup founder needs to make when they are just getting started:

What is often a point of frustration for founders is the chicken or the egg problem: capital is required to perform experiments and reach technical milestones, but you first need technical milestones to attract capital. Some of these milestones might not simply involve benchtop and in vivo proof-of-concept studies, but also a demonstration of a scalable and robust process to generate comparable doses for a clinical trial. It is therefore critical to work as efficiently as possible before the first formal financing round, or “Seed” round. Luckily there are options for startups to get off the ground:

- There are many non-dilutive sources of money available for cell therapy startups, including: SBIR and STTR grants, 7 pitch competitions, crowdfunding, grants from disease-specific philanthropic foundations, local economic development programs, potential government contracts, and biopharma-sponsored awards (such as JnJ’s QuickFire Challenge, 8 BMS’ Golden Ticket, 9 and many more)

- Raising a pre-seed round from angel investors or family offices that are passionate about your mission, or receiving capital from accelerator/incubator programs, such as IndieBio10 or Y Combinator 11

- Working as quickly and efficiently as possible with high-quality, yet cost-effective materials. This is where RoosterBio can come in. 12, 13

In the rush to translate early cell and gene therapy (CGT) breakthroughs, it’s sometimes assumed that any competent CRO/CDMO could rapidly fill in the blanks to create satisfactory trial material “out of thin air.” However, given the complex components and process required for clinical studies, this is not always the case. 14 Since biology is well-known to throw a curve-ball or two, 15 it helps to understand exactly how the cellular or molecular biofunction could be affected by their change in origin from an artisanal “workshop” to an industrial “foundry.” 16, 17 For such transitions to occur smoothly, regulatory-savvy companies 18 are beginning to set up as sites of catalysis, with inputs from the sponsoring startup and outputs feeding into cGMP (current Good Manufacturing Practice) cellular mass production. Here, we find that effort spent upfront to develop a robust bioprocess with standardized cells and media adds up to environmentally friendlier time and cost savings. 19 From this “detour,” one can emerge with a de-risked process that’s strong enough to weather the challenges of scale-up with no surprises or costly reversals.

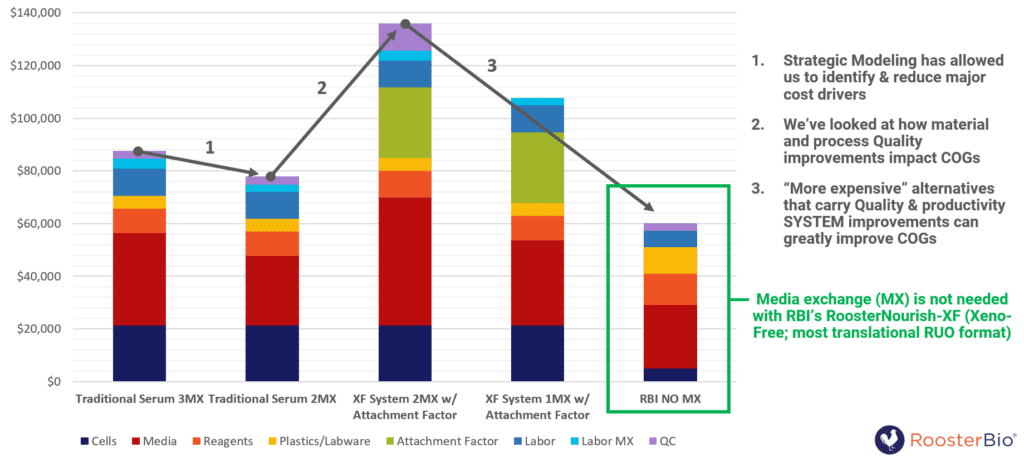

For startups in the mesenchymal stem cell (MSC) or extracellular vesicle (EV) / exosome space, RoosterBio’s products and services can be leveraged to not only move rapidly through experiments at an economical price (see figure below), but with materials that were specifically designed to be translationally friendly. 20, 21 We have spent the past 10 years perfecting our raw materials to be highly productive (so that you can use less and save money), platform-agnostic (easily scalable from 2D to 3D culturing systems), and consistent from preclinical (RUO products) to clinical (GMP products) studies. As our team contains many decades of person-years in MSC and EV/exosome bioprocess expertise, it is also a name that can instill confidence in investors, advisors, and other stakeholders.

Bill of Materials for MSC Expansion to 2-5B Cells: Traditional Method vs. RoosterBio’s Xeno-Free Platform

Figure Description: COGs savings when using RoosterBio materials. Traditional medias could require 1-3 media exchanges during MSC expansion, meaning you are using more media and therefore buying more bottles. Xeno-free (XF) formats also require additional factors to be added. RoosterBio’s media, RoosterNourish, does not require any media exchange for up to six days of culture, and is a standalone formulation that is highly productive. Therefore, you are using less media, require fewer seeding cells, eliminate the need for additional attachment factors, and will spend less money overall vs. traditional methods to procure the same final number of cells. Modified from RoosterBio webinar: “Best Practices in RegenMed Product & Process Development: Know Your Cost of Goods” 22

How is RoosterBio Going to Advance My Operation?

Apart from our raw materials, a key advantage in working with RoosterBio is the in-depth technical support we provide. When you have a startup with a lean budget and small team, RoosterBio can be thought of as an extension of your R&D group. This allows you to save costs on personnel while still getting expert advice on experimental design and execution.

Our support is provided free of charge with the purchase of our raw materials; however, with additional investment you could also delegate entire experiments or studies to our technical team with a formal services project. As more biotech companies move to a “virtual” format, it can reduce overhead and be more efficient to outsource experiments to service providers in lieu of standing up an independent lab and/or hiring more in-house scientists. Furthermore, you can have confidence in the industry-standard quality assurance and data analysis / management that is provided as a deliverable. Think of it as an “express lane” on a bridge between therapy ideation and clinical development (you can read more on “decentralized biotech” here, 23 or a CEO’s take on the virtual lab model here). 24

The value of Life Science Industrials companies, such as RoosterBio, is well-recognized 25 as a key growth driver of the healthcare industry. By working with these companies, startups can free up time for their teams to focus on the proprietary aspects of their technologies that will set them apart from the competition. As a Founder / CEO, this gained time will also be crucial as you embark on your fundraising roadshows and can’t be in the lab. For cell therapy startups founded over the past 5 years, it takes an average of ~2 years to raise the first $5M in venture capital (PitchBook). Therefore, it’s important to feel reassured that high-quality progress is being made while you shift focus to the business, with activities such as raising money, hiring, deal-making with potential partners, filing patents, mapping your near and long-term strategic plans, and making sure you’re not burning through your cash too quickly!

Furthermore, as shows like “Silicon Valley” depict, the entrepreneurial journey is fraught with ups and downs. Though there may not be as much drama, pithy dialogue, or eccentric characters, startups in the real world are constantly being told to be agile and ready to pivot. Pivots, whether made by choice or forced by market conditions, can be a natural part of a success story if they are handled gracefully. Not only has RoosterBio supported customers through application changes and portfolio expansions, but we are also able to match the agility of the startups we work with. Being a small to mid-size organization allows us to provide bespoke solutions for every customer, even having won awards for our solutions-oriented approach across many unique downstream use-cases.

How Does RoosterBio Fit into the Long-Term Roadmap?

As touched upon above, one costly mistake that startups can make is not considering their scaling strategy from the outset. This can be a detrimental error, as investors are often quick to ask questions such as “how will you actually get this to patients?”. It’s an elegantly simple question that can immediately signal to an investor how well you know your product and the business behind it.

Though your proposed “exit strategy” may involve an early M&A deal vs. going public and/or taking an advanced therapy to market on your own, most biopharma deals take place after an asset has been de-risked with some clinical data. In fact, most acquirers look for at least Phase II data, based on an analysis by Evaluate Vantage. 26 Furthermore, the average M&A deal size in 2018 was ~$1.5-2.5B for Phase II or Phase III assets, while it was <~$50M for preclinical assets. Therefore, scaling (or at least defining a path for scaling) will always be a necessary part of development to attract a deal with favorable returns.

We know it can be hard to think about the long-term picture when you are focused on the day-to-day hustle. Luckily, this is where RoosterBio shines. As your team gathers the requisite IND-enabling data, there will be a need to partner with experts who know how to expand cells or EVs to scale, with the proper regulatory boxes checked. With our expertise, we can help you both get your RUO processes in place to scale for animal studies, as well as develop a large-scale process for translation to cGMP. Our materials have been specifically designed to scale into 3D bioreactors, which will be necessary to develop a commercial MSC or EV-based therapeutic. RoosterBio also has ongoing public partnerships and/or collaborations with Sartorius, 27 PBS Biotech 28 and others, 29 and our team has experience from 100mL benchtop bioreactors to beyond 50 liter volumes. Moreover, our GMP cells and media are backed by Type II Master Files with the FDA, allowing for easy reference when filing your IND.

Can RoosterBio Still Help Me if I Haven’t Yet Started a Startup?

In today’s innovation-driven world, the entrepreneurial spirit is no longer limited to established startups with legal entities. It extends to a broader audience, including principal investigators, post-docs, and PhD students who are eager to commercialize their university-founded technologies. However, despite the growing interest, many find themselves unsure of where to begin.

Fortunately, the landscape is changing, with granting organizations increasingly incentivizing the commercialization of these technologies, and universities expanding their tech transfer offices with centers for entrepreneurship (more on how TTOs can support your academic spinout can be found in this episode 30 of Nature Careers Podcast, “Business of Science”). There are also government-sponsored programs, such as NSF I-Corps, 31 designed to specifically help early-stage academic entrepreneurs get their ideas off the ground.

Ultimately, the same principles outlined above are equally relevant when it comes to spinning out a company from academia. With RoosterBio, you gain access to a supportive community of experts that understands the unique challenges cell therapy researchers face. In fact, we have been cited in over 100 graduate thesis papers since our founding in 2014. For those that transfer their technologies to a startup, RoosterBio can be a constant thread that provides the technical guidance and resources needed to navigate the early days of entrepreneurship with confidence. A customer who recently spun a company out of their lab once told us “we would have never made it this far if it weren’t for RoosterBio”. We hope that RoosterBio can be the catalyst that empowers you to take that leap and transform your groundbreaking research into a successful startup venture.

Key Takeaways

The entrepreneurial journey can be equal parts frustrating, exhilarating, and rewarding. When starting a company, founders have many priorities, including keeping burn rate low, fundraising, and mapping a long-term strategy. RoosterBio can be a powerful resource to advanced therapy startups by:

- Providing highly scalable and economical raw materials to take you from the bench to the clinic and beyond, with regulatory guidelines in mind

- Offering (free) technical guidance along the way to help you plan and execute experiments with our materials and optimize your chance of success

- Providing expert-led services to advance your research quickly and efficiently, while helping you reduce overhead costs

In the end, speed is essential when it comes to delivering medicine to patients. When every moment counts, innovation and entrepreneurship move the needle between discovery and treatment. RoosterBio would be honored to accelerate your work and allow your burgeoning company to thrive.

References

- Grand View Research. Cell Therapy Market Size, Share, & Trends Analysis Report By Therapy Type (Autologous, Allogenic), By Therapeutic Area (Oncology, CVD, Dermatology), By Region, And Segment Forecasts, 2023 – 2030. https://www.grandviewresearch.com/industry-analysis/cell-therapy-market.

- Hildreth, Cade. List of U.S. FDA Approved Cell and Gene Therapy Products (27). https://bioinformant.com/u-s-fda-approved-cell-and-gene-therapies/.

- Verter, Frances, Silva-Couto, Pedro, and Bersenev, Alexy. 2021 Advanced Cell Therapy Summary. https://celltrials.org/news/2021-advanced-cell-therapy-summary.

- Sartorius Sartorius to acquire Albumedix, strengthening its portfolio of innovative advanced therapy solutions. https://www.sartorius.com/en/company/newsroom/corporate-news/sartorius-to-acquire-albumedix-strengthening-portfolio-of-innovative-advanced-therapy-solutions-1281024.

- ProKidney signs SPAC merger deal with Social Capital Suvretta -ProKidney delivers disease-altering autologous cell therapy to treat chronic kidney disease. https://www.pharmaceutical-technology.com/news/prokidney-spac-merger-deal/.

- Letson, Abigail. BioCentriq Acquired by GC for $73 Million https://biocentriq.com/biocentriq-acquired-by-gc-for-73-million/.

- U.S. Government. The SBIR and STTR Programs. https://www.sbir.gov/about.

- Johnson&Johnson INNOVATION. QuickFire Challenges. QuickFire Challenges. https://jnjinnovation.com/innovation-challenges

- Bristol Myers Squibb. “Golden Ticket” Contests. https://www.bms.com/business-development/early-innovation/golden-ticket-submission.html.

- INDIE-BIO. Skip the Accelerators. Come build with real VC. https://indiebio.co/.

- Y Combinator. Why Y Combinator? We give startups a disproportionate advantage. https://www.ycombinator.com/.

- Olsen, T. R.; Rowley, J. A., Corporate profile: RoosterBio, Inc. Regen Med 2018, 13 (7), 753-757. 10.2217/rme-2018-0092

- Rowley, J. Rapid Clinical Translation and Scale-Up of hMSCs and EVs. https://www.regmednet.com/webinars/rapid-clinical-translation-and-scale-up-of-hmscs-and-evs/.

- Scheiber, A. L.; Clark, C. A.; Kaito, T.; Iwamoto, M.; Horwitz, E. M.; Kawasawa, Y. I.; Otsuru, S., Culture Condition of Bone Marrow Stromal Cells Affects Quantity and Quality of the Extracellular Vesicles. Int J Mol Sci 2022, 23 (3). 10.3390/ijms23031017

- RoosterBio “One Does Not Simply Walk Into” a Therapeutic Cell Manufacturing Process… But the Long Road Need Not Be Perilous! https://www.roosterbio.com/blog/one-does-not-simply-walk-into-a-therapeutic-cell-manufacturing-process-but-the-long-road-need-not-be-perilous/.

- Kirian, R.; Wang, D.; Takacs, J.; Tsai, A.; Cruz, K.; Rosello, F.; Cox, K.; Hashimura, Y.; Lembong, J.; Rowley, J., Scaling a xeno-free fed-batch microcarrier suspension bioreactor system from development to production scale for manufacturing XF hMSCs. Cytotherapy 2019, 21 (5), S71-S72.

- Adlerz, K.; Trempel, M.; Wang, D.; Kirian, R.; Rowley, J.; Ahsan, T., Comparison of msc-evs manufatured in 2D versus scalable 3D bioreactor systems. Cytotherapy 2019, 21 (5), S58.

- Williams, Kathy, and Hansen, Caitlin. Quality Begins at Inception. https://www.roosterbio.com/blog/quality-begins-at-inception/.

- Agbojo, Omokhowa, Lim, Maya and Lembong, Josephine. Environmental Analysis of Therapeutic hMSC Manufacturing: A Comparison of Multiple Bioprocess Systems. https://www.roosterbio.com/blog/environmental-analysis-of-therapeutic-hmsc-manufacturing-a-comparison-of-multiple-bioprocess-systems/.

- Lembong, Josephine. and Rowley, Jon. Building Effective Multi-Year Process Development Programs I: Estimating hMSC Lot Size Ranges for Clinical Manufacturing Through Commercial Demand. https://www.roosterbio.com/blog/building-effective-multi-year-process-development-programs-i/.

- Lembong, Jospehine and Rowley, Jon. Building Effective Multi-Year Process Development Programs II: Evolution of Technology Platform Decisions Based on Lot Size. https://www.roosterbio.com/blog/building-effective-multi-year-process-development-programs-ii-evolution-of-technology-platform-decisions-based-on-lot-size/.

- Candiello, Joseph and Lim, Mayasari. Webinar: Best Practices in RegenMed Product & Process Development: Know your COGS. https://share.hsforms.com/1Ns3ZdJgFQKW05XATgdnfrQ3564o?

- Pearl, Jocelynn. Guide to Decentralized Biotech. https://future.com/a-guide-to-decentralized-biotech/.

- Halioua, Celine. Costs & Considerations of Using CROs as a Biotech Startup. https://www.celinehh.com/cros.

- Vogt, Reinhard. Life Science Industrials Are Key to the Growth of the Biopharma Industry. https://www.pharmasalmanac.com/articles/life-science-industrials-are-key-to-the-growth-of-the-biopharma-industry.

- Brown, Amy and Elmhirst, Edwin. Following the M&A money, by phase and therapy area. https://www.evaluate.com/vantage/articles/insights/ma/following-ma-money-phase-and-therapy-area.

- GlobeNewswire. RoosterBio Partners with Sartorius to Advance Cell and Gene Therapy Manufacturing. https://www.globenewswire.com/news-release/2021/01/14/2158806/0/en/RoosterBio-Partners-with-Sartorius-to-Advance-Cell-and-Gene-Therapy-Manufacturing.html.

- Lembong, J.; Kirian, R.; Takacs, J. D.; Olsen, T. R.; Lock, L. T.; Rowley, J. A.; Ahsan, T., Bioreactor Parameters for Microcarrier-Based Human MSC Expansion under Xeno-Free Conditions in a Vertical-Wheel System. Bioengineering (Basel) 2020, 7 (3). 10.3390/bioengineering7030073

- RoosterBio. Versatile Manufacturing Formats for Your Adherent Cell Therapy “Triathlon” & Its Bioprocess “Shoe Change”. https://www.roosterbio.com/blog/versatile-manufacturing-formats-for-your-adherent-cell-therapy-triathlon-its-bioprocess-shoe-change/.

- Levy, Adam. Business of science: How technology-transfer teams can help your spin-off succeed. Nature 2021. 10.1038/d41586-021-01005-y

- U.S. Government. NSF’s Innovation Corps (I-Corps™). https://new.nsf.gov/funding/initiatives/i-corps.